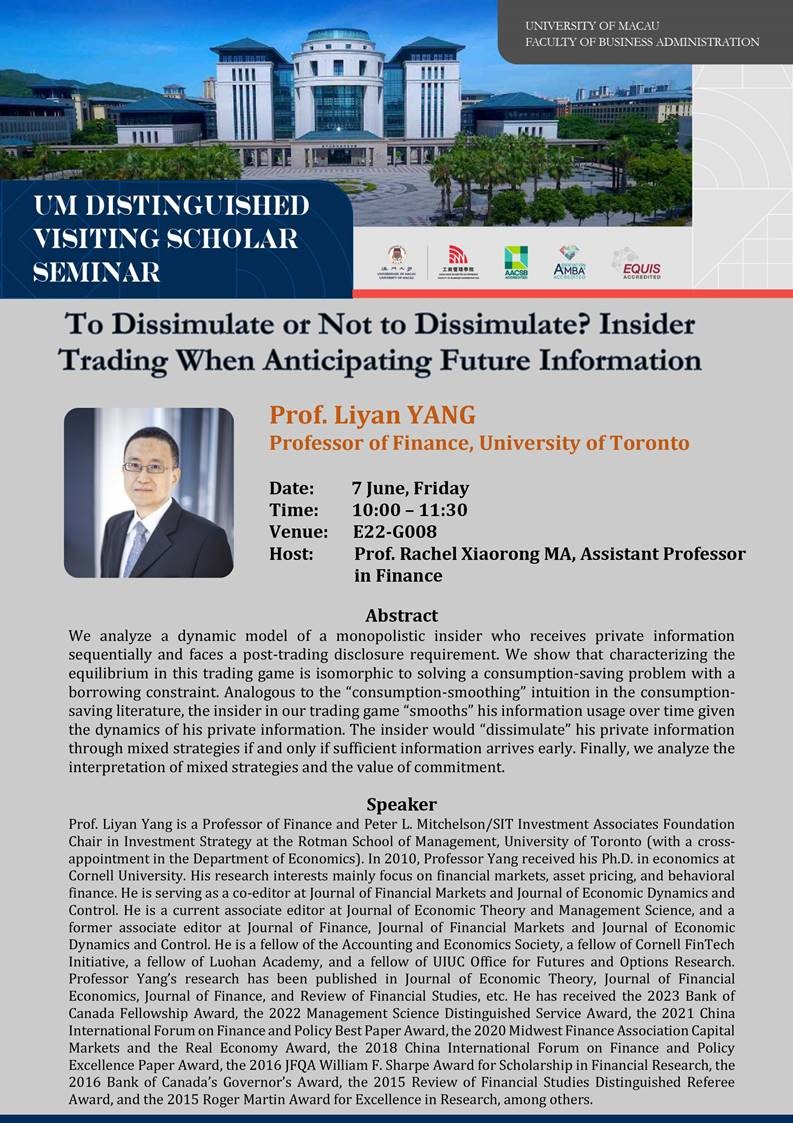

Presented by Prof. Liyan YANG

Professor of Finance, University of Toronto

Date: Friday, 7 June 2024

Time: 10:00 am

Venue: E22-G008

Language: English

Host: Prof. Rachel Xiaorong MA, Assistant Professor in Finance

Abstract

We analyze a dynamic model of a monopolistic insider who receives private information sequentially and faces a post-trading disclosure requirement. We show that characterizing the equilibrium in this trading game is isomorphic to solving a consumption-saving problem with a borrowing constraint. Analogous to the “consumption-smoothing” intuition in the consumption-saving literature, the insider in our trading game “smooths” his information usage over time given the dynamics of his private information. The insider would “dissimulate” his private information through mixed strategies if and only if sufficient information arrives early. Finally, we analyze the interpretation of mixed strategies and the value of commitment.

Speaker

Prof. Liyan Yang is a Professor of Finance and Peter L. Mitchelson/SIT Investment Associates Foundation Chair in Investment Strategy at the Rotman School of Management, University of Toronto (with a cross-appointment in the Department of Economics). In 2010, Professor Yang received his Ph.D. in economics at Cornell University. His research interests mainly focus on financial markets, asset pricing, and behavioral finance. He is serving as a co-editor at Journal of Financial Markets and Journal of Economic Dynamics and Control. He is a current associate editor at Journal of Economic Theory and Management Science, and a former associate editor at Journal of Finance, Journal of Financial Markets and Journal of Economic Dynamics and Control. He is a fellow of the Accounting and Economics Society, a fellow of Cornell FinTech Initiative, a fellow of Luohan Academy, and a fellow of UIUC Office for Futures and Options Research. Professor Yang’s research has been published in Journal of Economic Theory, Journal of Financial Economics, Journal of Finance, and Review of Financial Studies, etc. He has received the 2023 Bank of Canada Fellowship Award, the 2022 Management Science Distinguished Service Award, the 2021 China International Forum on Finance and Policy Best Paper Award, the 2020 Midwest Finance Association Capital Markets and the Real Economy Award, the 2018 China International Forum on Finance and Policy Excellence Paper Award, the 2016 JFQA William F. Sharpe Award for Scholarship in Financial Research, the 2016 Bank of Canada’s Governor’s Award, the 2015 Review of Financial Studies Distinguished Referee Award, and the 2015 Roger Martin Award for Excellence in Research, among others.